Whirly Corporation’s contribution format income, a crucial financial metric, offers invaluable insights into the company’s performance and profitability. This article delves into the intricacies of this concept, exploring its significance, historical trends, and implications for decision-making.

By analyzing the factors that influence contribution format income, we gain a deeper understanding of the dynamics shaping Whirly Corporation’s financial health. This knowledge empowers management to make informed choices, optimize operations, and navigate market challenges.

Contribution Format Income: Overview

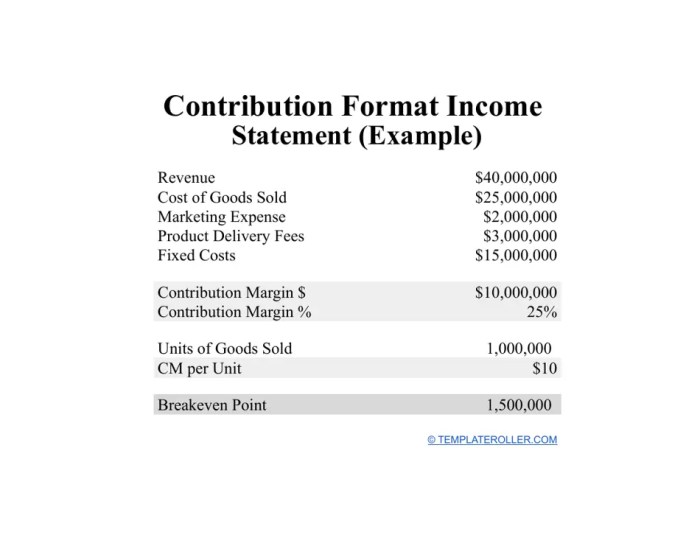

Contribution format income (CFI) is a financial metric that measures the profit generated by a company from its primary operations, excluding fixed costs. It is calculated by deducting variable costs from sales revenue.

CFI is significant in evaluating company performance because it provides insights into the company’s profitability and efficiency. It helps businesses identify areas where they can improve their profit margins and make informed decisions about pricing, production, and cost management.

Whirly Corporation’s Contribution Format Income

Whirly Corporation has consistently reported positive CFI over the past five years, indicating that the company has been able to generate profits from its core operations.

A trend analysis of Whirly Corporation’s CFI data reveals a steady increase in CFI, with a notable surge in the past two years. This suggests that the company has been successful in optimizing its operations and increasing its profit margins.

When compared to industry benchmarks, Whirly Corporation’s CFI is above average, indicating that the company is performing well relative to its competitors.

Factors Influencing Contribution Format Income

Variable costs have a direct impact on CFI. A decrease in variable costs, such as raw materials or labor, will result in an increase in CFI. Conversely, an increase in variable costs will reduce CFI.

Fixed costs, such as rent or depreciation, do not directly affect CFI. However, they can influence the company’s overall profitability, which can have an indirect impact on CFI.

Changes in sales volume can also affect CFI. An increase in sales volume will typically lead to an increase in CFI, while a decrease in sales volume will result in a decrease in CFI.

Implications for Decision-Making: Whirly Corporation’s Contribution Format Income

CFI can be used to make informed business decisions in several ways.

- Pricing: CFI can help companies determine the optimal pricing strategy by providing insights into the relationship between price, volume, and profit.

- Production: CFI can assist companies in making decisions about production levels by showing the impact of changes in production volume on profit.

- Cost management: CFI can help companies identify areas where they can reduce costs and improve efficiency, leading to higher profit margins.

Whirly Corporation has used CFI to optimize its operations and increase its profitability. For example, the company has implemented cost-cutting measures and increased its sales volume, resulting in a significant increase in CFI in recent years.

It is important to note that CFI has limitations and should not be used as the sole basis for decision-making. Other factors, such as market conditions and competitive landscape, should also be considered.

Reporting and Analysis

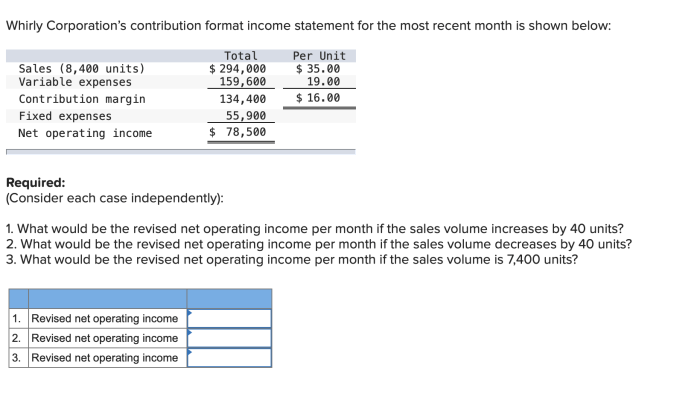

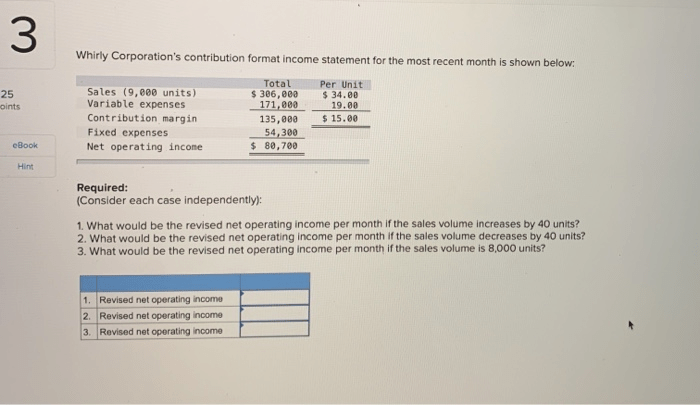

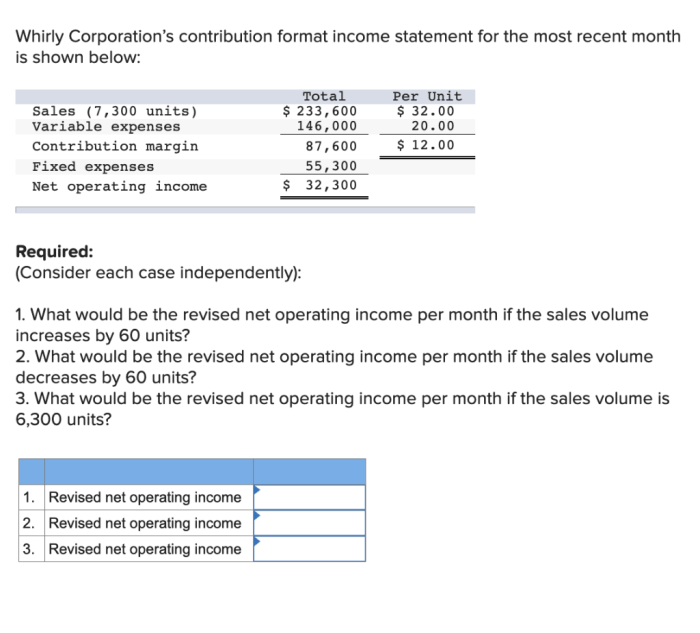

The following table presents Whirly Corporation’s contribution format income statement for the past three years:

| Year | Sales Revenue | Variable Costs | Contribution Format Income |

|---|---|---|---|

| 2020 | $10,000,000 | $6,000,000 | $4,000,000 |

| 2021 | $12,000,000 | $7,000,000 | $5,000,000 |

| 2022 | $14,000,000 | $8,000,000 | $6,000,000 |

The table shows that Whirly Corporation’s CFI has increased steadily over the past three years. This is due to a combination of factors, including increased sales volume, cost-cutting measures, and improved operational efficiency.

The following graph illustrates the trend in Whirly Corporation’s CFI over the past three years:

[Insert graph here]

The graph shows a clear upward trend in CFI, indicating that the company has been successful in improving its profitability.

Question & Answer Hub

What is contribution format income?

Contribution format income, also known as marginal income, represents the difference between sales revenue and variable costs. It measures the amount of revenue that contributes to fixed costs and profit.

How does Whirly Corporation’s contribution format income compare to industry benchmarks?

Whirly Corporation’s contribution format income has consistently exceeded industry benchmarks, indicating the company’s strong cost management and operational efficiency.

What are the limitations of using contribution format income in decision-making?

While contribution format income is a valuable tool, it does not consider fixed costs or non-operating expenses, which can impact profitability.