Quincy listed information from his credit report – Quincy’s Credit Report: A Comprehensive Guide to Analyzing Listed Information for Financial Well-being

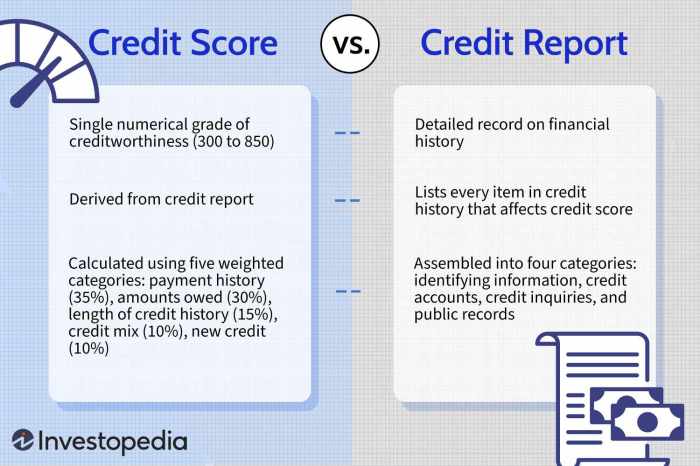

Credit reports play a crucial role in assessing financial health and determining access to credit. Quincy’s decision to review his credit report serves as a valuable case study, highlighting the significance of understanding the information listed on these reports. This guide delves into the types of information typically found on a credit report, emphasizing the importance of carefully examining it to identify and address any errors or discrepancies.

Introduction: Quincy Listed Information From His Credit Report

Credit reports play a crucial role in financial well-being, serving as a comprehensive record of an individual’s credit history and financial obligations. Analyzing the information listed on a credit report provides valuable insights into one’s financial standing, allowing for informed decision-making and proactive credit management.

To understand the significance of credit reports, consider the hypothetical scenario of Quincy. Quincy decides to review his credit report to assess his financial health and prepare for a major purchase. A credit report typically contains information such as personal details, credit accounts, payment history, credit inquiries, and public records.

Analyzing Listed Information

Careful examination of the information listed on a credit report is paramount. Identifying and addressing any errors or discrepancies can significantly impact credit scores and overall financial standing. Errors may include incorrect personal information, inaccurate payment records, or unauthorized credit accounts.

Addressing these errors promptly can prevent negative consequences and improve creditworthiness.

Common Issues

- Incorrect personal information: Errors in name, address, or Social Security number can lead to identity theft and credit fraud.

- Inaccurate payment records: Missed or late payments reported incorrectly can lower credit scores.

- Unauthorized credit accounts: Fraudulent accounts opened in one’s name can damage credit history and lead to financial loss.

Dispute Process, Quincy listed information from his credit report

Disputing errors or inaccuracies on a credit report involves contacting the credit bureau that issued the report. Supporting documentation, such as payment receipts or proof of identity, is typically required. The credit bureau has a legal obligation to investigate the dispute and respond within a specified timeframe.

Resolving disputes promptly can rectify errors and improve credit scores.

Monitoring and Maintenance

Regularly monitoring credit reports for any changes or updates is essential for maintaining a positive credit history. Credit scores and report information can fluctuate over time due to various factors. Staying informed about these changes allows for timely action to address any potential issues.

Online credit monitoring services or periodic reviews can provide convenient ways to track credit activity.

General Inquiries

What types of information are typically included on a credit report?

Credit reports typically include personal identifying information, credit accounts, payment history, credit inquiries, and public records.

Why is it important to review my credit report regularly?

Regularly reviewing your credit report helps you identify and address errors, monitor your credit score, and stay informed about changes to your financial standing.

What steps should I take if I find errors on my credit report?

If you find errors on your credit report, you should dispute them with the credit reporting agencies and provide supporting documentation to prove your claim.